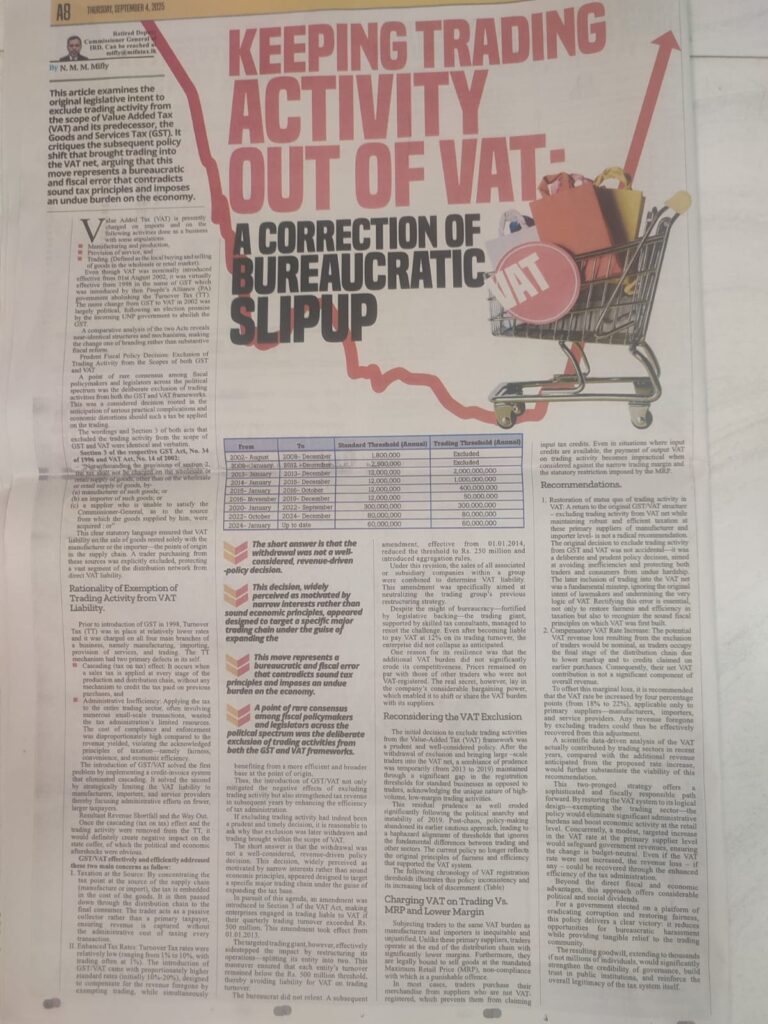

A recent expose, “Keeping Trading Activity out of VAT: A Correction of Bureaucratic Slip-Up,” reveals a long-standing fiscal blunder: local trading—simple buying and selling—was never meant to be taxed under VAT, yet it slipped in due to bureaucratic oversight. The original laws were clear: ordinary trading should have been exempt from regulation.

Here’s what you need to know:

- In the late 1990s and early 2000s, when GST (later renamed VAT) was introduced, lawmakers intentionally excluded trading activity from the tax framework to protect local businesses and prevent economic distortion.

- However, over time, shifting policies quietly reintroduced trading into VAT, creating confusion and unfair financial pressure on local traders who were never intended to be included.

This is more than a technical tax issue—it’s an opportunity for real change. Correcting this oversight could lift a heavy burden from businesses, simplify compliance, and make the playing field fairer for everyone.