Cyclone Ditwah has tested Sri Lanka not only in terms of physical resilience but also in terms of institutional responsiveness, social solidarity, and policy fairness. While the country has demonstrated remarkable unity and compassion—both from those directly affected and from those who voluntarily contributed to relief efforts—the existing tax framework has exposed certain gaps that warrant urgent attention.

It must be borne in mind that examinations or tax audits relating to losses claimed now are likely to take place after a minimum period of two years—possibly in the latter part of 2027. By then, the magnitude of the devastation caused by Ditwah may have faded into history, and the prevailing sense of sympathy and empathy may no longer influence the tax authority, making it critically important for affected taxpayers to retain all relevant records to substantiate their claims for losses and related expenses.

- Affected individuals and businesses may deduct genuine Ditwah-related losses, including damage to trading stock, capital assets, and repair expenditure, under Sections 17 and 19 of the Inland Revenue Act, subject to proper documentation. These losses can reduce current taxable income and, where they create net business losses, may be carried forward for up to six years under existing rules.

- Taxpayers are strongly urged to maintain comprehensive evidence—such as photographs, Grama Niladhari or Police confirmations, and purchase invoices—because audits are likely only around 2027, long after public memory of the disaster has faded. Without such records, genuine loss claims risk being challenged despite the clear legal basis for deduction.

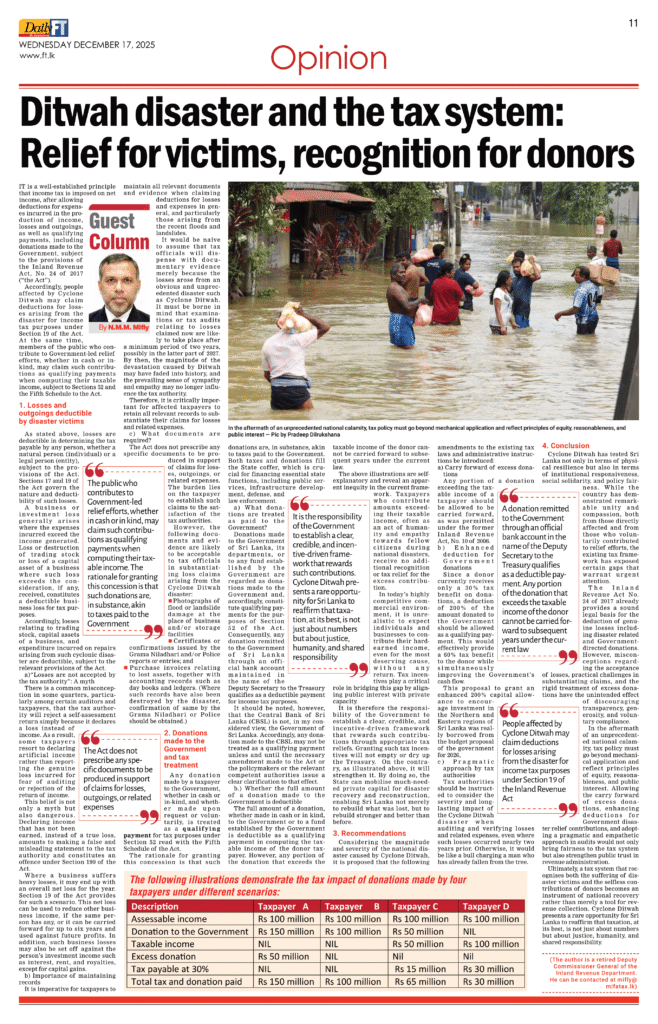

- Donations made in cash or in kind to the Government of Sri Lanka or to Government-established funds, routed through official Treasury accounts, qualify as deductible payments when computing taxable income under Section 52 and the Fifth Schedule. However, any portion of a donation exceeding the donor’s taxable income is not allowed to be carried forward under the current law, resulting in an inequitable outcome for more generous contributors.

- The article argues that the Government should introduce targeted reforms: allowing carry forward of excess donations, granting an enhanced 200% deduction for Government disaster-relief donations, and instructing tax authorities to adopt a pragmatic, empathetic approach in auditing Ditwah-related losses. Such measures would better align tax policy with fairness, encourage voluntary compliance, and mobilise private capital for long-term recovery and reconstruction.

- Overall, the piece calls for a tax regime that recognises both the suffering of disaster victims and the generosity of donors, turning taxation into an instrument of national recovery rather than a purely revenue-raising tool. Cyclone Ditwah is presented as an opportunity for Sri Lanka to reaffirm that taxation, at its best, reflects justice, humanity, and shared responsibility.